Supply Chain Scanner - Week of March 17, 2025

Weekly blog by Emily Atkins

Managing through chaos: How to navigate the new tariffs

The best way to manage imports and exports in the face of the new tariffs imposed by the United States and the retaliatory Canadian duties is to use all the tools at your disposal to create and execute a new business strategy.

That was the top-line takeaway from a webinar hosted by CITT and presented by CH Robinson on March 13, 2025. Three presenters from the CITT-partner customs and logistics provider shared their expertise and tips for companies facing a rapidly shifting, and frankly scary, new customs landscape.

The webinar started out by asking participants what their top concern was regarding the new tariffs. The two biggest concerns expressed by the approximately 100 participants were increased costs to procure goods (noted by 44%) and impacts to transportation budgets (25%).

Ryan Hammett, CH Robinson’s director of market intelligence insights, outlined strategies that shippers can consider for dealing with the fluid situation. In a three-phase approach, Hammett recommended shippers first identify risks, including exposure to the tariffs; the elasticity of the prices you can charge for your products; your time and resources available to modify your supply chain; the potential duration of the tariffs; and, inefficiencies in your existing operations.

Regarding the last point, Hammett said, “Many of you have established networks and infrastructure that you've spent years and millions of dollars establishing. If you're inflexible with those, then I'd encourage you to take a serious look at your operational processes. My experience over many years is that shippers would rather put pressure on external parties to deliver cost savings than sometimes do the difficult internal work between departments to make operational or technology changes to unlock savings.”

To mitigate the risks, the next step is researching options What free-trade agreements exist that might help your company find new markets? Do those potential new market or supplier countries have the infrastructure needed to move goods effectively at the scale you need them?

Then you need to evaluate what it will cost you and how long it will take to make the changes.

Finally, in collaboration with finance, supply chain and sales teams, you would establish best- and worst-case scenarios and decide which of those justify immediate action versus those that are just backup plans in case of trade policy changes.

Hammett emphasized the importance of creative thinking when working on this problem, citing the example of a holding company he works with. “Each of their companies was making siloed decisions, and they had a huge total landed cost opportunity if they would work together across that portfolio, bundling some of these elements instead of everyone acting separately,” he recounted. “Now is the time to think creatively and to pursue ideas that maybe you weren't willing or able to pursue in the past.”

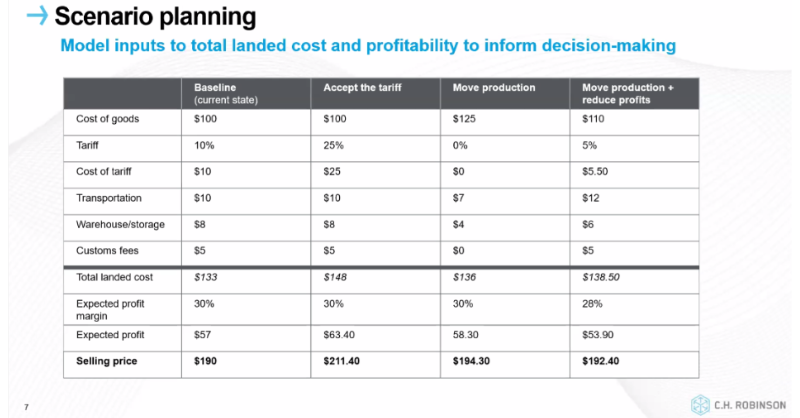

Hammett shared an analytical tool that examines the cost of goods under different scenarios –accepting the tariff, moving production and moving production with reduced profit – assessing the tariff cost, transportation cost, warehousing and storage and customs fees and comparing the total landed cost under each possible situation.

As you consider these costs, Hammett pointed out that “while it may cost more to produce something in Mexico, Canada or the US compared to China, if the duties are lower or non-existent, and transportation costs are lower, that change may become worth it to produce the product closer to the target market.”

For a more specific Canadian perspective, Hammett turned the presentation over to Brad Hogeterp, product development manager for customs, Canada at CH Robinson. “The biggest variable we do not have a clear understanding of is what the total duty rate is or could be, and what's applicable and for how long, and on what goods is it effective?” Hogeterp said.

“So, it's very difficult to plan. It sure looks and feels like a trade war at the moment, and reciprocal tariffs could, in a cumulative way, ratchet up duties on exported goods. Our response in Canada is likely to be commensurate, understanding how reliant our Canadian economy is on trade.”

Hogeterp’s advice is to stay on top of changing policies and understand what your options are for cost reduction and to what extent your price can include uncertain duty measures. Ensuring compliance is critically important, he said. Proper tariff classification and customs filings are critical to avoid potential penalties.

Planning for disruption is also going to be important. Expect increased customs clearance delays, and potential shifting or changing US demand, which is currently causing broader freight logistics challenges and cost fluctuations, Hogeterp advised. He also urged shippers to make note of the new surety bond requirement under CBSA’s CARM coming into effect on April 19th.

Brittney Lubinsky, CH Robinson’s US-based business development manager, highlighted a number of sources that shippers can follow to keep up with trade policy developments. She strongly suggested using only official sources of information to avoid the risk of being steered in a bad direction.

She also highlighted some tools available to shippers. These include using bonded warehouses and freight to ship through the US; taking advantage of the ACH program from US CBP; using direct payments to CBSA; ensuring your bond is up to date and adequate to your needs; and using contract negotiations with suppliers to mitigate the effects of tariffs.

Hammett wound up the presentation, saying: “We just want to stress the importance of being prepared. The trade policy landscape lately has been changing daily, which makes it really challenging to know how to proceed.

“You should probably decide in advance where will you be proactive versus reactive, which risks that we talked about earlier require you to make a long-term change no matter what versus the ones you can probably wait out, the more you can align on the criticality and priority, the faster you can move.”

If you would like to view our recent webinar on Navigating the New Tariff Landscape, please click here. Join our industry experts to explore what the changes could mean for your global supply chain so you can leverage these shifts to gain a competitive edge.

Join the conversation on Canada’s Logistics Community forum!

Emily Atkins

President

Emily Atkins Group

Emily Atkins is president of Emily Atkins Group and was editor of Inside Logistics from 2002 to 2024. She has lived and worked around the world as a journalist and writer for hire, with experience in several sectors besides supply chain, including automotive, insurance and waste management. Based in Southern Ontario, when she’s not researching or writing a story she can be found on her bike, in a kayak, singing in the band or at the wheel of her race car. LinkedIn: https://www.linkedin.com/in/emilyatkinsgroup/